Issue #197 - Deepshit or Deepseek???

Deepshit...

Trades are for educational purposes and not a recommendation or financial advise.

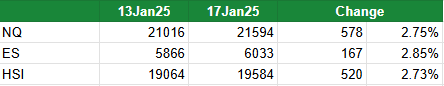

Scorecard

All up for the week.

Today market was in Deepshit because of Deepseek… :P Market possibly finding reason to selloff using the Deepseek story. There may be some new story coming out from people like Jensen Huang tomorrow on how NVDA GPUs will still be relevant etc. Watch NVDA as it is now back to post share split price.

TOOK PROFIT ON IWM AND XOP STRANGLE

Both trades were closed last week at profit level of 50% and 60%.

IWM stock price is now back to around $227. It is possible to structure another strangle trade into 21 March expiry. 245C and 205P collecting around $2.80-$2.90 premium, with buying power of $2800. Probability of Profit (POP) is 75% with POP 50% is 86%.

XOP continue to slide. For now, it is possible for XOP to continue to slide in line with the drop in crude oil prices. After it breaks below, $135 watch the price action, if it holds at this level, it is possible to do another strangle. If it drops down below back to $125 level, we can structure some cash secured puts at Delta 20. Lets see how the price action plays put in the next days/weeks.

Trades are for educational purposes and not a recommendation or financial advise.

DISCLOSURES

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options: https://www.theocc.com/components/docs/riskstoc.pdf

MYstyework is an Online Financial Literacy Educator and materials provided is solely by MYstylework and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Trading securities can involve high risk and the loss of any funds invested. MYstylework, through its contents, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. MYstylework is not in the business of transacting securities trades or an investment adviser.

Exited NVDA synthetic longs from the dip buy ☺️

Just 2 days in, the new IWM strangle we took is at 16% profits. NVDA is back up 10% from Deepseek selldown (we took some positions and now in profit). PLTR also back to 80, we exited some synthetic from selldown 200%+ up... as we always say...market likes to screw people with newsflows.... most people panic from it and a few profit from it 😚