Trades are for educational purposes and not a recommendation or financial advise.

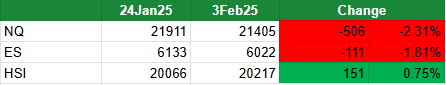

Scorecard

Tariff fears in the US markets pulled back the markets from going higher. It’s a game of poker and let’s see who is the Poker King. Definitely not Canada for now. Mexico possibly and China has some of chips on hand to drag the game. EU just came into the game yesterday.

TRADING CRYPTO ETFs

Today we're exploring an exciting topic, trading options on Cryptocurrencies Exchange Traded Funds. Since last year, many funds have issued Cryptocurrencies ETFs and droves of people who never got involved in cryptocurrencies because of the complexities of registering on a crypto exchange and having wallets which require some technical knowledge and a good memory for passwords (which I am pretty bad at losing many wallet passwords and seed phrase…)

Now, it is just like buying stock from your brokerage and of course you need to pay some management fees to these fund managers, but what’s a fraction of a percentage to get away from direct holding of Cryptocurrencies and these cryptocurrencies moves so much every second or minute anyway, you lose track of the decimal percentages…

Some of the more notable ETFs are IBIT, BTC, FBTC and ARKB all optionable but just stick to IBIT and possibly BTC for options trade as liquidity and spreads can be wide as they are still fairly new to options traders.

Of course there are also Ethereum ETF like Grayscale Ethereum Trust ETF (ETHE).

We are going to explain today how it can be a more cost-effective alternative to buying Bitcoin directly. We'll also discuss the risks involved and strategies to improve returns.

Firstly, Bitcoin ETFs are financial products that allow investors to gain exposure to Bitcoin without directly holding the cryptocurrency. These ETFs track the price of Bitcoin, providing a convenient and regulated way to invest in the digital asset. One such ETF is the iShares Bitcoin Trust (IBIT), which offers a way to participate in Bitcoin's price movements through a traditional stock market vehicle.

Next, Options trading on IBIT involves buying and selling options contracts, which give you the right, but not the obligation, to buy or sell shares of IBIT at a predetermined price before the contract expires. This can be a powerful tool for leveraging your investment and managing risk.

But remember, Options are decaying products with an expiry date. If it don’t work your way, it will become worthless at expiry, unlike direct cryptocurrency and ETFs where you own it and you can wait for the price to come back to profitability in months or even years.

To explain, we will use IBIT Options as an example.

One of the main advantages of trading IBIT options is the cost-effectiveness compared to buying Bitcoin directly. With Bitcoin priced today at $101,702.60 and IBIT priced at $57.71, you would need approximately 1,762.56 IBIT shares to equal 1 Bitcoin. Instead of purchasing these shares outright, you can use options to control a similar position with less capital.

Let's break it down. If you buy 1 call options on IBIT, you can control 100 shares per contract. To control 1 Bitcoin, you will have to buy around 17-18 IBIT Options contract. Depending on which strike price and duration you chose, the cost for these contracts will vary. Generally, the longer the duration and the further In The Money strike price against the market price will cost higher. But still a fraction of the cost to owning 100 units of the ETFs or buying Bitcoin direct (leverage aside).

While options trading offers significant potential, it's important to understand the risks involved. Here are some key risks to consider:

High Volatility: Bitcoin and IBIT are known for their price volatility, which can lead to significant losses if the market moves against your position.

Complexity: Options trading requires a good understanding of the market and the specific mechanics of options.

Time Decay: Options lose value as they approach expiration, which can erode your investment if the underlying asset doesn't move as expected.

Profit from Volatility Swings into your Trade Direction and Early Exits

One strategy to improve returns is to exit your options positions early, targeting a 20-25% return on your buying power. This approach helps lock in profits and reduce the risk of holding options until expiration. As bitcoin tend to swing in a volatile manner, capture those swings into your trade direction and exit when you get 20-30% profit target.

Lock in your profits and reinitiate new trade when price is favourable either at support, resistance, oversold or overbought. By doing this you capitalise on price movements without exposing to further market risk.

You need a small move in Bitcoin Price to get a 20% ROI on Options trade

To achieve a 20% return on investment (ROI) using IBIT options, let's calculate how much Bitcoin needs to move. Suppose you buy IBIT call options expiring June 2025, with a strike price of $50, and the premium is $12.75 per option. The buying power or cost of trade is $1275.

If you aim for a 20% ROI on your buying power, you need the value of the options to increase by 20% which is from $1275 to $1530. This means the underlying IBIT price needs to rise enough to increase the option's value.

Options decay aside, given the current IBIT price of $57.71, a 20% increase in the option's value would require IBIT to rise to approximately $61.70. This corresponds to a moderate increase in Bitcoin's price, reflecting the leveraged nature of options. Assuming a factor of 1752.56 IBIT equals to 1 bitcoin, the move in Bitcoin price is $108,132, which equals to only a 6.3% price increase in Bitcoin. How exciting that a 6.3% move in underlying can result in a 20% return through a bitcoin option!

This is as a result of a significant leveraged return using options compared to direct Bitcoin investment.

Trading options with the IBIT ETF can be a cost-effective and strategic way to gain exposure to Bitcoin. Nevertheless, it's crucial to understand the risks and employ strategies like early exits to improve returns.

Quick Entry on IBIT using Ratio Strategy

A call options ratio is a defined risk trade involving buying 2 ITM calls and selling one OTM call. The trade will profit if it moves above the existing stock price on entry and we compensate the options decay in the 2 call options through the short call extrinsic value decay. Indirectly, we have somewhat created a synthetic stock through the ratio strategy, but with a limited downside.

Trade Entry (DTE 21 March)

Current price of IBIT is $56.35 and Bitcoin $99,068.

Buy 2 Call strike $52

Sell 1 Call strike $57

Total debit is $9.79, blocked buying power is $979 and 20% ROI will require the option price to be $11.75 ( profit of $196). Indicatively, IBIT needs to move to around $58.60 for the trade to generate 20% profit. The trade has a delta of around 85 equivalent to holding 85 IBIT shares, which cost around $4790.

Bitcoin price needs to move from $99,068 to $103,286, up 4.3% from current.

Max loss is $979 being the debit paid. We can also do a stop loss if price of Bitcoin breaks below 92,000 or at 50% of the max loss.

Trades are for educational purposes and not a recommendation or financial advise.

DISCLOSURES

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options: https://www.theocc.com/components/docs/riskstoc.pdf

MYstyework is an Online Financial Literacy Educator and materials provided is solely by MYstylework and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Trading securities can involve high risk and the loss of any funds invested. MYstylework, through its contents, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. MYstylework is not in the business of transacting securities trades or an investment adviser.