Issue #201 - Recycling IWM Strangle

Recycling IWM Strangle...

Trades are for educational purposes and not a recommendation or financial advise.

Market Scorecard

Market is weak with NQ dropping more than 7% and ES more by 5%. On contrast HSI has remained strong in anticipation of positive news flows coming out from the CCP Meetings in China, ongoing.

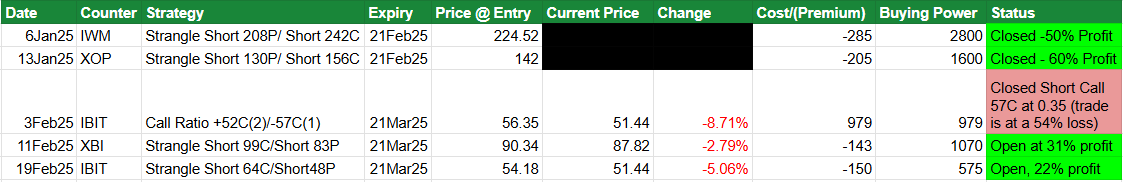

Trade Scorecard

IBIT Call Ratio (Update)

IBIT has hit roller coaster with selloff to a low of $46.07. Price has since recovered to $51.44.

We closed the short call 57C on 27 February when IBIT hit lows of $46.90 for $0.35. Now the 57C is priced at $0.82. The reason why we closed it is because there was little extrinsic value left to protect the $52 long calls. If we closed it, any price recovery will not have friction on the short call side. Had we not closed it, the loss would have been higher by $0.47 per current price. To breakeven, IBIT would need to move to $58.50 to $59 in the next week or so. That’s around 1.8x expected move for 21 March expiry which is quite difficult to achieve. The trade is now at a loss of $528. We will likely close the trade at a smaller loss if BTC hits 98,000 level or IBIT hits $55.50 within this week. Regardless, we will close the trade by this week as we do not have enough time for IBIT to recover.

Trades are for educational purposes and not a recommendation or financial advise.

STRANGLE ON XBI (UPDATE)

XBI dropped around 3% since entry and now trading at $87.82. Nevertheless, the drop is still within the 7-8% buffer range we have. As is it looks like XBI hit a low of $84.07 and bouncing back up. Good sign for the trade and it is around 22% in profit. If price comes back to the $90 level, we can possibly ride the trade into full profit till expiry.

Trades are for educational purposes and not a recommendation or financial advise.

STRANGLE ON IBIT (UPDATE)

Despite high volatility on IBIT recently, the trade is now in profits of around 31%. As IBIT fell towards the downside earlier, we were not that concerned eventhough it went in the money on the $48 short put. As we said earlier, if IBIT went ITM on the short put side, you need to be ready to pick it up or roll for longer duration. We would have been more worried if it went pass the short call, but luckily that did not happen.

For now, we just let time pass and monitor the price action. If IBIT moves back to $56-$58 area, we can take profit and exit the trade. If it goes back down to $48 area, be ready to roll the trade for more premium. Preferably, do the rolling before it gets in the money.

Trades are for educational purposes and not a recommendation or financial advise.

RECYCLING IWM STRANGLE

There is no shame in doing the same kind of trade day in day out. In fact, if one strategy works, we can rinse and repeat until it does not work anymore. Good trades are meant to be boring and slow. Excitement on fast paced trades like trading stocks like Tesla, can end up badly.

So lets move in again in our IWM strangle. We explained how to do the trade in our previous issue #194 on 7 January 2025. It’s just selling at strikes at delta 16 short call and short put. Based on IWM price today of around $208, using 17 April expiry, sell a short call at $223 and sell a short put at $188. Premium received is $3.48 with buying power blocked around $2400. ROI is around 14% for 42 days. Profitability of profit is 72%.

Adjust as necessary on opening.

As usual, monitor price action of IWM. As it dropped already so much, a continuation of a drop will be beneficial for the trade as it could reach extreme oversold situation and rebounce back up. With time decay working for us, such move would make our trade very profitable and safe.

Trades are for educational purposes and not a recommendation or financial advise.

DISCLOSURES

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options: https://www.theocc.com/components/docs/riskstoc.pdf

MYstyework is an Online Financial Literacy Educator and materials provided is solely by MYstylework and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Trading securities can involve high risk and the loss of any funds invested. MYstylework, through its contents, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. MYstylework is not in the business of transacting securities trades or an investment adviser.