Options Trading Newsletter - Issue #113

Getting Lucky... [Options Today - Using Expected Move For Trade Setup]

Getting Lucky…

Some people have all the luck…

I recall that we often say this when we see a guy getting together with a pretty girl in school when others had failed to do so…

He was just lucky while others did not manage to court her… Well, do you think it was just luck or something else that had made him “the man” of her choice? Come to think of it today, I would have seen it differently. I cannot imagine how much efforts that guy had put in to win her heart, how many messages he sent her, how many jokes he cracked to make her smile, how many gifts he sent her and how many other things that he had done to move her heart until one day, she accepted him into her arms.

The only thing that made him lucky is just the number of chances he took to be disappointed or get rejected. To get his face to show up more often than others to get him noticed and consistently doing the things that will make her accept him as a friend.

Some people don’t stay long enough after a couple of rejections, and those who consistently show up just have more chances to win.

It’s the same in everything you do in life. There is no pure luck, it is a matter of the number of tries you make and you don’t stop until you get “lucky”.

""Success is not a matter of luck, but of perseverance through failures and rejections."

SPX (4124)

SPX had hardly moved from last week’s close.

CPI came out on Wednesday at 4.9% vs 5.0% forecast. Market rallied initially but fizzled shortly as a 0.1% reduction is really nothing to cheer about and be supportive data for the Fed to confirm pivoting to stop increasing and take a maintenance stance at 5.25% from the next Fed Rate Hike meeting on 14 June 2023. As J.Powell put it. the Fed will be data dependent to decide what is going to be their next move and we still have one more CPI release before the next FOMC meeting.

As said earlier, SPX has been range bound over the levels between 4050 to 4170. For the week, if we look at a smaller 15 minutes timeframe, we can see that the range narrowed to between 4100 to 4145, a tight 45 points range. We can see this range as a first level support/resistance, before the price action breaking above or below to test the bigger range gap of 4050 to 4170.

The trading range for the week is between 4050 and 4150.

NDX (13340)

NDX has only gained slightly by 81 points for the week. Although it broke above 13200 and stayed above that level throughout the week, it retraced at the end of the week, probably some profit taking. NDX has gone up around 27% from its lows in October 22 and also nearing the 50% retracement level of 13600. There is much headwind as now earnings season is almost over and the heavyweights have all posted better than expected earnings that has helped pulled the market up so far.

The DXY (USD Index) seem to be holding support at 101 level and gained strongly last Friday. Remember DXY has an inverse direction to the stock market. If this level breaks down, potentially signaling further upside for the stock market.

The trading range for the week is between 13200 and 13550.

HANG SENG INDEX (19627)

HSI opened the week strongly looking to break back above 20,000 level. Current supports holds at 19500 with weekly 50 MA also holding as another support. Tuesday morning, Retail sales and unemployment rate will be announced.

OPTIONS TODAY - USING EXPECTED MOVE FOR TRADE SETUP

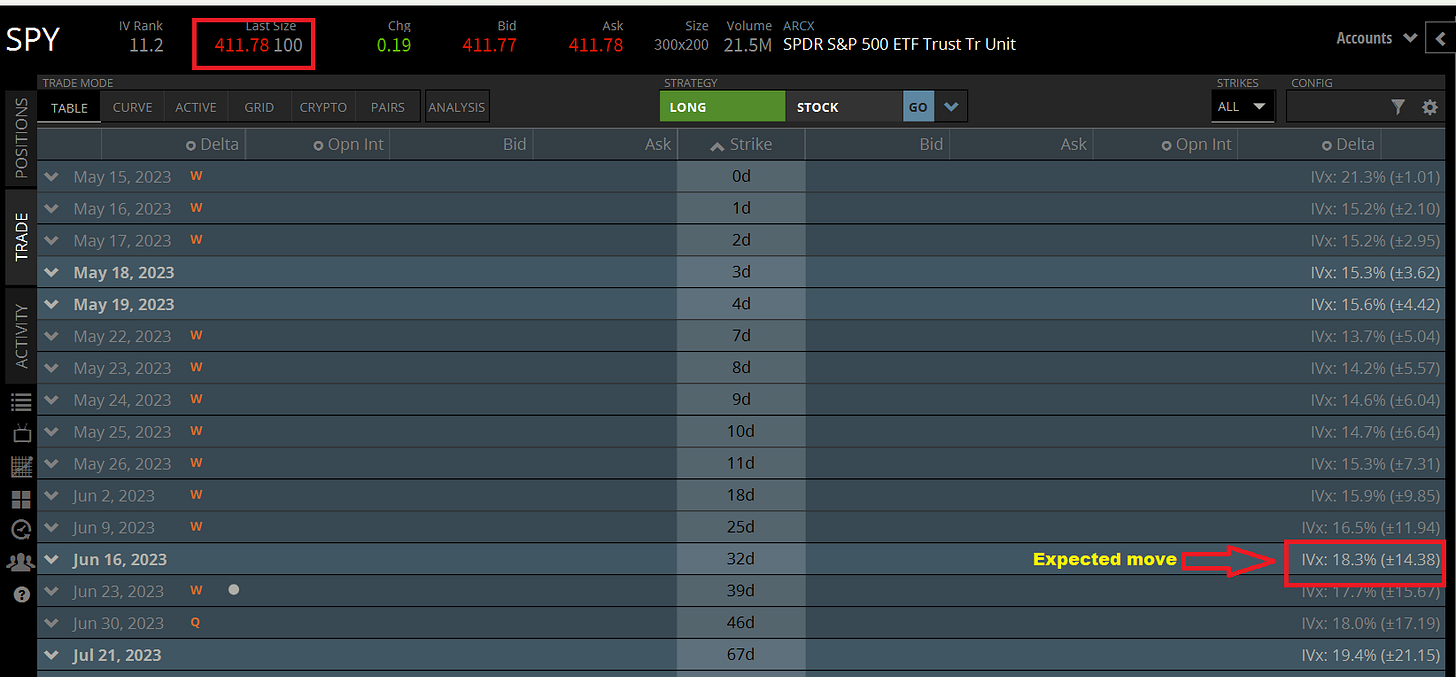

Using options, we can determine the expected move of the stock price with 68% probability. We won’t go through how you calculate this but you can get this directly off the trade platform, which is shown within the options chain below.

Currently, SPY is trading at $411.78. The expected move for expiry 16 June is +/-$14.38. Which means SPY can either go up by $14.38 or go down by $14.38. As at end of 16 June 2023, SPY is expected to trade at either:-

$411.78-$14.38 = $397.40

or $411.78 + $14.38 = $426.16

Once we determine this expected move, we can use this to place our strikes and trades. Example:-

Naked Put - Strike below $397, example Selling a Put at $395 would provide a probability of profit of 82%.

Bear Call Spread - Strike above $426, selling a Call at $427 and buying a Call at $432, would give a probability of profit of 76%

Bull Put Spread - Strike below $397, selling a Put at $395 and buying a Put at $390, would give a probability of profit of 79%

Iron Condor - Bear Call Spread and Bull Put Spread above would give a probability of profit of 57%.

Conclusion

As shown above, we can use Expected Move to determine trade strike prices and then strategy which we can use to trade. We can plot the Expected Move on the chart as shown by the green lines. Based on this chart, a Bear Call Spread would be good based on a potential resistance at $430, just slightly above the Expected Move.

TRADERS TALK

Our previous show below if you had not the chance to see it….

Send us an email @ support@mystlework.com if you have any questions and we can cover them during the show.

Review our past traders talk. Let more of your friends know about our show and let them benefit also. View Past Traders Talk here.

Follow-us so you will be notified when we go live! Follow and click on the notification button, so you will never miss a show.

TIKTOK VIDEOS

Understanding IV - Part 1 - Understanding IV relation to options premium and how to read different measurement of IVs.

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

Understanding IV- Part 2 - How to use IV to trade GLD ETF.

DELTA is one of the most important Options Greek. Understand what it represents and how to use it to improve tour trading and how it is used for hedging and also capital and return management.

Iron Condor Trade on XOP. Get FREE petrol trading options. FREE Options Trading Newsletter https://mystylework.substack.com.

How to use Advanced Options Strategies to hedge your long term stock investment for free. Learn Options Trading for Free

Trading Options Using Jade Lizzard strategy. Get free petrol subsidies trading XOM 😏 #optionstrading #investing101 #stockmarket #xom

Banks don't want you to know this secret. Revealed in one of our earlier Traders Talk in June 2021. #banksecrets #investing101 🌈✨🏝️

Generate Property like cash flows from the stock market with only one fifth the capital. #Hello2023 #propertyinvesting #rentalincome #investing #stockmarket

Investing 101. It is difficult to catch the bottom and catch the best prices but we can tranch in our buy points so we can get the best overall long term returns without missing the boat. #hello2023 #investing #apple

Trade Digest on XBI - Trading Range using Iron Condor options strategy live from Traders Talk 27 Dec 22. #optionstrading #tastyworks

Long Trade on JD. Trade setup from Traders Talk 6 Dec 22 #optionstrading #tastyworks — www.tiktok.com TikTok video from Mystylework (@mystylework.trade): "Long Trade on JD. Trade setup from Traders Talk 6 Dec 22 #optionstrading #tastyworks". JD Long Trade | 6 Dec 22 Traders Talk | Like & Share ♥️. Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Trade Digest On XLE using Iron Condor #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Trade Digest On XLE using Iron Condor #optionstrading #optionsstrategies". Iron Condor on XLE | Trading in Range Use A Neutral strategy | Iron Condor | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

5 ways to reduce cost of calls. The ultimate traders' guide. #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "5 ways to reduce cost of calls. The ultimate traders' guide. #optionstrading #optionsstrategies". 5 Ways To Reduce Cost Of Calls | options trading | traders | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Trading options with 68.2% probability using Expected Move 😎 #optionstrading #trading101 — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Trading options with 68.2% probability using Expected Move 😎 #optionstrading #trading101". Expected Move | How to trade options | trading options | .... Corporate Uplifting Inspirational Motivational Pop Rock Piano Violins Theme Song.

mystylework.trade (@mystylework.trade) on TikTok — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade). Butterfly Trade | How to setup low cost high returns options trade | Learn to trade options | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Winning Options Strategies everyday. Creating high probability low risk trades 😎 #optionstrading #optionsstrategies #elonmusk @tastytrade — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Winning Options Strategies everyday. Creating high probability low risk trades 😎 #optionstrading #optionsstrategies #elonmusk @tastytrade". Elon Musk | Stock trading | Another WIN 😎 | .... Sunrise.

Twitter shareholder's meeting for takeover by Elon Musk 13 Sep 22, 10am. Lets trade... #optionstrading #optionsstrategies @tastytrade — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Twitter shareholder's meeting for takeover by Elon Musk 13 Sep 22, 10am. Lets trade... #optionstrading #optionsstrategies @tastytrade". select Nov 18 expiry | Sell ATM call strike 43 | recheck ATM price on open on Monday | .... TikTok's song-like tropical house(974524).

J.Powell's Message yesterday in 1 minute... @tastytrade #optionstrading #optionstrading #stockmarket — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "J.Powell's Message yesterday in 1 minute... @tastytrade #optionstrading #optionstrading #stockmarket". Fed Message??? 🏦 | Responsibility For Price Stability.... | Inflation Target | .... Suns.

What to expect for this week's market.. #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "What to expect for this week's market.. #optionstrading #optionsstrategies". SPX down 141 points (3.37%) last Friday after J.Powell speech | Monday another 27 points drop | but we see some slight support at 4000 level above daily 50 MA | .... Change My Mind.

Option Trade on JD - watchlist at last Traders Talk on 9 Aug. Closed today $922 profit 🤑 #optiontrading #tradingstrategy — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Option Trade on JD - watchlist at last Traders Talk on 9 Aug. Closed today $922 profit 🤑 #optiontrading #tradingstrategy". Option Trade JD covered potential trade during 9 Aug Traders Talk Entry 9 Aug Exit 26 Aug Profit $922 | watch till end to see the trade we did 😉 | Option Trades Adjustments - Based on Price Actions | .... YOU'RE MY SUNSHINE.

Hawkish remarks by J Powell crushed the market - pullback expected until Next FOMC in Sept 21. Watch for key points raised #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Hawkish remarks by J Powell crushed the market - pullback expected until Next FOMC in Sept 21. Watch for key points raised #optionstrading #optionsstrategies". Key Points For Traders | Here's what JP said.. | > rates will go up until inflation is down to 2% | .... Flip through.

FACEBOOK

Visit and follow us at our Facebook Page for more contents!

Access here >>Facebook Page<<

DISCLOSURES

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options: https://www.theocc.com/components/docs/riskstoc.pdf

MYstyework is an Online Financial Literacy Educator and materials provided is solely by MYstylework and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Trading securities can involve high risk and the loss of any funds invested. MYstylework, through its contents, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. MYstylework is not in the business of transacting securities trades or an investment adviser.

With the market so range bound, it seems like iron condors could be good plays for the near future.