AI Wrath… [Options Today- Neutral Trade on SPY]

Artificial Intelligence is here to stay and there is no doubt about it. In our previous Newsletter we did show you how we could make money off it if we use it intelligently and profited with a 9% return on investment in 1 month. In fact, we are continuing to generate around 2% return weekly with the help of AI to validate our trade strategies.

If you have not tried to use AI, I urge you to pick it up and see which area it can help you in your daily work. ChatGPT is one AI tool which comes in handy on many task. Microsoft Copilot 365 is another which will even be more powerful as it is going to be ChatGPT integrated into your daily applications like Office 365 and more. For USD40 subscription per month, is nothing compared to what you will get out of the service.

Notwithstanding how AI can change our way of working for the better, AI obviously has a darker side as it can be used on practically anything you can imagine. Over the weekend, I was binging on Netflix, Youtube & also Prime on some war movies and one of it is about AI Robots being tested as future combat soldiers. Use of Robots as soldiers is already fearful and to add in AI into the soldiers brain is another wicked level. Firstly the mass production of an army is possible by any corporation and can be sold to anyone willing to pay for the product, not only a government but anyone who have deep pocket to create its own army battalion, you can imagine a Narco Gang buying a couple hundred of it to protect its business as an example. Then putting in AI which can eventually think for itself and make decision based on the situation. One cannot exclude the possibility that humanity is destroyed like in the movie Terminator.

So as much as we like AI, we have to be careful how it develops in the future and governance is not all that bad as long as equal emphasis is put in on all applications especially those can be used in weapons of mass destruction.

"AI can do great good, but it can also do great harm."

SPX (4320)

The bears had its week again. Since FOMC decision, SPX had retraced around 4% and closed at 4320. Even the 100 daily MA is just broken off without much resistance. However last Friday, we saw that the bulls tried to regain its territory but failed to do so after several run up and sold off towards close again.

We look at Monday now if SPX can hold support and go back above 4328. If it could not hold, the next leg down is towards 200 daily MA of around 4200, which should hold as a strong support level.

Thursday is the unemployment claim and at market close Fed Chairman J.Powell speaks. This may shed more light with regards to the possibility of another hike this year and provide some market moving action.

Trading range for the week is 4200 and 4400.

Until then, watch the levels and stay small in your trades. As we have said, equity movements are still volatile and commodities are more predictable for now. GLD has been moving up since August but still within a slow sideway band pattern (176-180.5). This bodes well for our 1SD Weekly Strangle Strategy.

As for oil we see that it starts to face resistance at 90 levels. It broke above for a week but could not hold long. Coming into the last quarter and into winter, we could see that the hot spell could cause less consumption and accordingly releasing price pressure on oil despite production supply being controlled.

NDX (14701)

It does not look good for NDX as prices continues to plumet. September has been a full bear territory up till now and we have now broken down the 100 daily MA. If the last low of 14557 is broken, we could see it go down to the next level of 14300.

Trading range for the week is between 14300 to 15050.

NFLX continue to drop along with the overall bearish market for the past week. As it sits now on 380 and if it can’t hold, the next level will be 360 also around 200 daily moving average. We still keep a tight watch on this stock for now.

HANG SENG INDEX (18057)

HSI had a big bullish Friday up 402 points (2.3%) after it hit support at 17573. Surprisingly, the negative price action on Thursday from the US market had no bearing to the HSI for Friday. This could signify that there is strong support and buying at levels below 17500. However, 18200 could be a resistance point again for the move up on HSI.

OPTIONS TODAY [Neutral Trade on SPY]

With VIX spiking back up to 17 many stocks IV has also increased making it meaningful to sell premium on stocks. The SPY ETF IV Rank also increased together with the recent pullback, now at 23 with IV levels at 17% from lows of 12-13%. The 5 day IV change has also increased by 3.1% till Friday.

At $430, price action wise, we are at a level where we were 1 month ago right in the middle of a price band of 410-450, which coincides with 1 Standard Deviation move for the 17 November option expiry.

Neutral Option Strategies

(a) Iron Condor

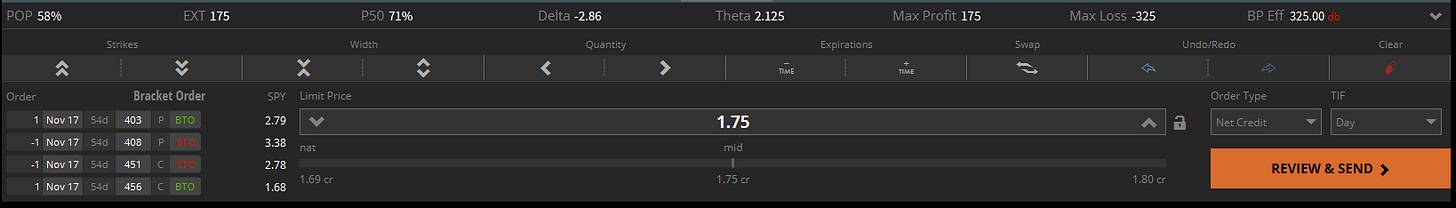

We can apply neutral option strategies such as Iron Condor with a Delta 20 Strike price for the short call and short put. With a $5 width, we can get a premium of $175 risking $325 per trade for the 17 November expiry of 54 days. $2.12 Theta decay/day.

Trade Entry

Sell OTM Put 408, Buy 403 Put

Sell OTM Call 451, Buy 456 Call

Total credit collected $1.75

(at open today, recheck the Delta 20 option strikes and premium)

Trade Exit & Trade Management

Can exit at 50% profit target ($1.75 x 50%).

Technically, we do not need to manage the trade until any of the short strikes gets close to or ITM. If remaining days to expiry remains 21 days or less, we can roll the tested side for some credits to buy more time for it to get back OTM.

(b) Credit Strangle

Another more aggressive trade strategy is by using a strangle as this is an undefined risk trade. Do not use this strategy if you do not know what risk it entails as the risk on the upside is unlimited.

We would normally perform this using a Delta 16 strangle.

Trade Entry and Trade Management

Sell an OTM Call at strike 402

Sell and OTM Put at strike 455

Total premium collected $452 with buying power of $6150.

As price of SPY fluctuates up and down and at times can be a big swing move to one direction, it may not be necessary to make adjustments if we still have ample time left on the trade. Nevertheless, we would see a loss position on the trade in such an instance unless the price comes back to the middle of the band.

If we have only 21 days remaining to expiry, we may need to adjust if price is ATM or ITM by rolling the tested side to buy more time for the strike to get back OTM.

Another adjustment method is to roll up/down the untested side, which require active management as and when there are large price movements to one side. For example if price goes up, then we can roll the short put upwards for more credit or vice versa. Note however with each adjustment the band of the profit target range gets smaller and at one point, your strikes may become inverted and trades converts into an iron fly. As said, a strangle strategy is more complex and requires full understanding for trade management and we could caution you to use this strategy unless you are fully aware of the how to and risks associated. We did cover this strategy on one of our past Newsletter in detail. You may refer to it there.

Conclusion

When volatility sets in, options premium increases and options sellers will get paid enough to take on the risk even for low IV products like SPY. As we are half way down the price action from the highs, it may be suited to enter into neutral trades as the stock can move both ways and our trade will still be profitable, as long as it stays within the upper or lower boundry. Even if price continue to slide, it may reach an oversold position by or close to expiry and hence a retracement up to get back within the price band close to expiry. By understanding, IV, price action and trade adjustments, neutral trade strategies can provide us with worry free and high win probability trades.

OPTIONS TODAY [Update on APPL Earnings Trade]

As AAPL went ITM at the last rolling, we were exercised at 180 strike and now holds 200 AAPL shares. We do not intend to sell the stock and will manage the trade by selling calls the next opportunity we have when AAPL stock price moves back closer to $180. Minimum strike to sell the call would be 180.

TRADERS TALK

Review our past traders talk. View Past Traders Talk here.

Follow-us so you will be notified when we go live! Follow and click on the notification button, so you will never miss a show.

TIKTOK VIDEOS

AI Validation on Options Strategy - GLD ETF using Strangle. We used ChatGPT Code Interpreter to backtest the strategy and WIN probabilities. #AI #optionstrading #chatgpt #codeinterpreter

Options Today - Bullish Trade on Apple. Increase Probability of Profits from below 40% to more than 80%. Trade as explained in our Options Trading Newsletter No.124. 31 July 23

Options Today - Trade on GLD As described in our Options Trading Newsletter Issue No.123, Jade Lizard on GLD. Entry 26.7.23. [This video is AI from my personal voice] 🤭 #optionsstrategy

Understanding IV - Part 1 - Understanding IV relation to options premium and how to read different measurement of IVs.

Understanding IV- Part 2 - How to use IV to trade GLD ETF.

DELTA is one of the most important Options Greek. Understand what it represents and how to use it to improve tour trading and how it is used for hedging and also capital and return management.

Iron Condor Trade on XOP. Get FREE petrol trading options. FREE Options Trading Newsletter https://mystylework.substack.com.

How to use Advanced Options Strategies to hedge your long term stock investment for free. Learn Options Trading for Free

Trading Options Using Jade Lizzard strategy. Get free petrol subsidies trading XOM 😏 #optionstrading #investing101 #stockmarket #xom

Banks don't want you to know this secret. Revealed in one of our earlier Traders Talk in June 2021. #banksecrets #investing101 🌈✨🏝️

Generate Property like cash flows from the stock market with only one fifth the capital. #Hello2023 #propertyinvesting #rentalincome #investing #stockmarket

Investing 101. It is difficult to catch the bottom and catch the best prices but we can tranch in our buy points so we can get the best overall long term returns without missing the boat. #hello2023 #investing #apple

Trade Digest on XBI - Trading Range using Iron Condor options strategy live from Traders Talk 27 Dec 22. #optionstrading #tastyworks

Long Trade on JD. Trade setup from Traders Talk 6 Dec 22 #optionstrading #tastyworks — www.tiktok.com TikTok video from Mystylework (@mystylework.trade): "Long Trade on JD. Trade setup from Traders Talk 6 Dec 22 #optionstrading #tastyworks". JD Long Trade | 6 Dec 22 Traders Talk | Like & Share ♥️. Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Trade Digest On XLE using Iron Condor #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Trade Digest On XLE using Iron Condor #optionstrading #optionsstrategies". Iron Condor on XLE | Trading in Range Use A Neutral strategy | Iron Condor | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

5 ways to reduce cost of calls. The ultimate traders' guide. #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "5 ways to reduce cost of calls. The ultimate traders' guide. #optionstrading #optionsstrategies". 5 Ways To Reduce Cost Of Calls | options trading | traders | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Trading options with 68.2% probability using Expected Move 😎 #optionstrading #trading101 — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Trading options with 68.2% probability using Expected Move 😎 #optionstrading #trading101". Expected Move | How to trade options | trading options | .... Corporate Uplifting Inspirational Motivational Pop Rock Piano Violins Theme Song.

mystylework.trade (@mystylework.trade) on TikTok — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade). Butterfly Trade | How to setup low cost high returns options trade | Learn to trade options | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Winning Options Strategies everyday. Creating high probability low risk trades 😎 #optionstrading #optionsstrategies #elonmusk @tastytrade — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Winning Options Strategies everyday. Creating high probability low risk trades 😎 #optionstrading #optionsstrategies #elonmusk @tastytrade". Elon Musk | Stock trading | Another WIN 😎 | .... Sunrise.

Twitter shareholder's meeting for takeover by Elon Musk 13 Sep 22, 10am. Lets trade... #optionstrading #optionsstrategies @tastytrade — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Twitter shareholder's meeting for takeover by Elon Musk 13 Sep 22, 10am. Lets trade... #optionstrading #optionsstrategies @tastytrade". select Nov 18 expiry | Sell ATM call strike 43 | recheck ATM price on open on Monday | .... TikTok's song-like tropical house(974524).

J.Powell's Message yesterday in 1 minute... @tastytrade #optionstrading #optionstrading #stockmarket — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "J.Powell's Message yesterday in 1 minute... @tastytrade #optionstrading #optionstrading #stockmarket". Fed Message??? 🏦 | Responsibility For Price Stability.... | Inflation Target | .... Suns.

What to expect for this week's market.. #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "What to expect for this week's market.. #optionstrading #optionsstrategies". SPX down 141 points (3.37%) last Friday after J.Powell speech | Monday another 27 points drop | but we see some slight support at 4000 level above daily 50 MA | .... Change My Mind.

Option Trade on JD - watchlist at last Traders Talk on 9 Aug. Closed today $922 profit 🤑 #optiontrading #tradingstrategy — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Option Trade on JD - watchlist at last Traders Talk on 9 Aug. Closed today $922 profit 🤑 #optiontrading #tradingstrategy". Option Trade JD covered potential trade during 9 Aug Traders Talk Entry 9 Aug Exit 26 Aug Profit $922 | watch till end to see the trade we did 😉 | Option Trades Adjustments - Based on Price Actions | .... YOU'RE MY SUNSHINE.

Hawkish remarks by J Powell crushed the market - pullback expected until Next FOMC in Sept 21. Watch for key points raised #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Hawkish remarks by J Powell crushed the market - pullback expected until Next FOMC in Sept 21. Watch for key points raised #optionstrading #optionsstrategies". Key Points For Traders | Here's what JP said.. | > rates will go up until inflation is down to 2% | .... Flip through.

FACEBOOK

Visit and follow us at our Facebook Page for more contents!

Access here >>Facebook Page<<

DISCLOSURES

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options: https://www.theocc.com/components/docs/riskstoc.pdf

MYstyework is an Online Financial Literacy Educator and materials provided is solely by MYstylework and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Trading securities can involve high risk and the loss of any funds invested. MYstylework, through its contents, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. MYstylework is not in the business of transacting securities trades or an investment adviser.