Options Trading Newsletter - Issue #138 Enduring Legacy... [Options Today - Post Earnings Play - Bearish on AMD]

Enduring Legacy... [Option Today - Post Earnings Play - Bearish on AMD]

ENDURING LEGACY… [Options Today - POST EARNINGS PLAY - BEARISH ON AMD]

Yesterday, I delved into the rich past history of a legend “Bruce Lee” at his ancestral home in Guangdong, China. He is famed as a martial arts legend and a Hollywood superstar, it’s lesser-known that Lee's journey was fraught with adversity. lesser-known that Lee's journey was fraught with adversity. At a young age, he left his family to pursue education and opportunities in the United States, setting the stage for his future as a martial arts instructor and later as an actor. His path was marred by racial discrimination, a nearly fatal injury, and financial hardship.

These did not deter him to become a well known martial star expert and one of the earliest Asian Hollywood superstar. Although his life was tragically cut short at age 32, his spirit endures as a beacon of inspiration, influencing countless individuals and leaving a profound impact on martial arts and cinema. Bruce Lee's enduring legacy is not just in his fame, but also in his exemplification of resilience and the "never say never" mindset that continues to illuminate the journeys of those who follow in his footsteps.

Leaving a piece of the Legend of the Dragon with you….

“Knowing is not enough, we must apply, Willing is not enough, we must do… - Bruce Lee”

SPX (4358)

SPX held support and bounced strongly gaining 240 points (5.8%) for the week, something which we have not seen for long. Each day opens with gap ups and now SPX seems to want to go higher after putting behind most economic data releases such as Fed Fund rate and unemployment/non-farm payroll.

It now seems to be looking to test resistance level of 4400 again. If it breaches, we may well go into the year end rally as most retail would be hyped with the idea of an incoming Santa Clauss Rally.

Trade range for the week is 4250 to 4500.

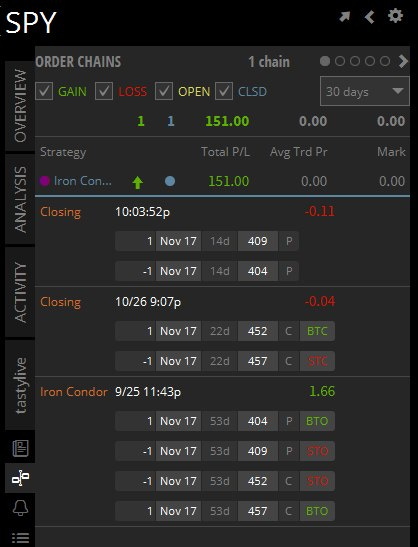

Our neutral play on SPY covered in our newsletter issue #132 played out perfectly as our trade. We shared below price thesis:-

“When volatility sets in, options premium increases and options sellers will get paid enough to take on the risk even for low IV products like SPY. As we are half way down the price action from the highs, it may be suited to enter into neutral trades as the stock can move both ways and our trade will still be profitable, as long as it stays within the upper or lower boundry. Even if price continue to slide, it may reach an oversold position by or close to expiry and hence a retracement up to get back within the price band close to expiry. By understanding, IV, price action and trade adjustments, neutral trade strategies can provide us with worry free and high win probability trades.

Price came down after entry and we legged out of the Bear Call Spread when its extrinsic value went below $0.05, leaving a Bull Put Spread which initially went ITM and in the runup this week, we exited the Bull Put Spread when the leg turned profitable. Overall we took in 90% of the premiums.

NDX (15099)

NDX turned around last week but maybe too fast and in a haste. Even if the Fed Chair has affirmed that hikes in current year is unlikely, there is still no change in expectation that rates will only taper down in June 2024. The negative unemployment and jobs report is also not much to shout about as we only see these numbers slightly lower than last quarter. Does this justify for a 6.5% increase in a week?

Price wise, we see that there is a resistance line which it bounced off at close on Friday. To confirm, a change in mid term direction, we need still to see a breach above this resistance line and also the break of previous lower high of 15333.

Trading range for the week is between 14850 to 15750.

This week’s earnings to watch.

HANG SENG INDEX (17664)

HSI went up last week and we could see HSI retesting the 18000 level. The resistance on the down channel is still valid and we could see it to move sideways and come back lower continuing the channel down move of lower lows.

We went long last week after HSI went down below 17,000 and bouncing off above this level. Some positions we exited on Friday and some on open today.

The lower support now at 17000 and resistance at 18000.

OPTIONS TODAY [EARNINGS PLAY WINNER - PLTR]

We exited the trade with 67% of the max profit earned within 3 days.

OPTIONS TODAY [POST EARNINGS PLAY - BEARISH ON AMD]

AMD went up 16%+ after earnings and was a bit too much and too fast. We expect some retracement to come in the next days or week and hence is entering into a bearish position using a Bull Put Spread.

We expect that AMD hitting resistance at the triple top formation and bounce back lower, expected to the levels of $104/5 before possibly going higher. Hence, we are going to do a very short trade with 2 weeks expiry as the max profit of a Bull Put Spread is earned close to expiry. As we do not expect the retracement to be extended for a long time and just a short term retracement. Further, the overall big market rally last week could also cause a short term retracement bring down AMD temporarily.

Trade Entry (17 Nov Expiry)

But an ATM Put at $112

Sell an OTM Put at $109

Total debit paid $1.20, max profit $1.80.

Trade Management

Exit at 50-60% of max profit.

Exit at 50% loss if AMD breaks above the resistance line of $111.8 and stays above moving higher.

HELP US GROW

Thanks for being a regular reader of our newsletter. We hope you had enjoyed reading as much as we enjoyed delivering it to you over more than 2 years now. If you value what we write, we hope you can help us grow our readership. We have just touched 13 US states and 19 countries. We think we can do better with your help as you would know 1-2 friends in states or countries which we are not there yet. Recommend us to your friends, share what you have learnt from us as they might too benefit from it… Thanks in advance 😉.

TRADERS TALK

Review our past traders talk. View Past Traders Talk here.

Follow-us so you will be notified when we go live! Follow and click on the notification button, so you will never miss a show.

TIKTOK VIDEOS

AI Validation on Options Strategy - GLD ETF using Strangle. We used ChatGPT Code Interpreter to backtest the strategy and WIN probabilities. #AI #optionstrading #chatgpt #codeinterpreter

Options Today - Bullish Trade on Apple. Increase Probability of Profits from below 40% to more than 80%. Trade as explained in our Options Trading Newsletter No.124. 31 July 23

Options Today - Trade on GLD As described in our Options Trading Newsletter Issue No.123, Jade Lizard on GLD. Entry 26.7.23. [This video is AI from my personal voice] 🤭 #optionsstrategy

Understanding IV - Part 1 - Understanding IV relation to options premium and how to read different measurement of IVs.

Understanding IV- Part 2 - How to use IV to trade GLD ETF.

DELTA is one of the most important Options Greek. Understand what it represents and how to use it to improve tour trading and how it is used for hedging and also capital and return management.

Iron Condor Trade on XOP. Get FREE petrol trading options. FREE Options Trading Newsletter https://mystylework.substack.com.

How to use Advanced Options Strategies to hedge your long term stock investment for free. Learn Options Trading for Free

Trading Options Using Jade Lizzard strategy. Get free petrol subsidies trading XOM 😏 #optionstrading #investing101 #stockmarket #xom

Banks don't want you to know this secret. Revealed in one of our earlier Traders Talk in June 2021. #banksecrets #investing101 🌈✨🏝️

Generate Property like cash flows from the stock market with only one fifth the capital. #Hello2023 #propertyinvesting #rentalincome #investing #stockmarket

Investing 101. It is difficult to catch the bottom and catch the best prices but we can tranch in our buy points so we can get the best overall long term returns without missing the boat. #hello2023 #investing #apple

Trade Digest on XBI - Trading Range using Iron Condor options strategy live from Traders Talk 27 Dec 22. #optionstrading #tastyworks

Long Trade on JD. Trade setup from Traders Talk 6 Dec 22 #optionstrading #tastyworks — www.tiktok.com TikTok video from Mystylework (@mystylework.trade): "Long Trade on JD. Trade setup from Traders Talk 6 Dec 22 #optionstrading #tastyworks". JD Long Trade | 6 Dec 22 Traders Talk | Like & Share ♥️. Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Trade Digest On XLE using Iron Condor #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Trade Digest On XLE using Iron Condor #optionstrading #optionsstrategies". Iron Condor on XLE | Trading in Range Use A Neutral strategy | Iron Condor | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

5 ways to reduce cost of calls. The ultimate traders' guide. #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "5 ways to reduce cost of calls. The ultimate traders' guide. #optionstrading #optionsstrategies". 5 Ways To Reduce Cost Of Calls | options trading | traders | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Trading options with 68.2% probability using Expected Move 😎 #optionstrading #trading101 — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Trading options with 68.2% probability using Expected Move 😎 #optionstrading #trading101". Expected Move | How to trade options | trading options | .... Corporate Uplifting Inspirational Motivational Pop Rock Piano Violins Theme Song.

mystylework.trade (@mystylework.trade) on TikTok — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade). Butterfly Trade | How to setup low cost high returns options trade | Learn to trade options | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Winning Options Strategies everyday. Creating high probability low risk trades 😎 #optionstrading #optionsstrategies #elonmusk @tastytrade — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Winning Options Strategies everyday. Creating high probability low risk trades 😎 #optionstrading #optionsstrategies #elonmusk @tastytrade". Elon Musk | Stock trading | Another WIN 😎 | .... Sunrise.

Twitter shareholder's meeting for takeover by Elon Musk 13 Sep 22, 10am. Lets trade... #optionstrading #optionsstrategies @tastytrade — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Twitter shareholder's meeting for takeover by Elon Musk 13 Sep 22, 10am. Lets trade... #optionstrading #optionsstrategies @tastytrade". select Nov 18 expiry | Sell ATM call strike 43 | recheck ATM price on open on Monday | .... TikTok's song-like tropical house(974524).

J.Powell's Message yesterday in 1 minute... @tastytrade #optionstrading #optionstrading #stockmarket — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "J.Powell's Message yesterday in 1 minute... @tastytrade #optionstrading #optionstrading #stockmarket". Fed Message??? 🏦 | Responsibility For Price Stability.... | Inflation Target | .... Suns.

What to expect for this week's market.. #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "What to expect for this week's market.. #optionstrading #optionsstrategies". SPX down 141 points (3.37%) last Friday after J.Powell speech | Monday another 27 points drop | but we see some slight support at 4000 level above daily 50 MA | .... Change My Mind.

Option Trade on JD - watchlist at last Traders Talk on 9 Aug. Closed today $922 profit 🤑 #optiontrading #tradingstrategy — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Option Trade on JD - watchlist at last Traders Talk on 9 Aug. Closed today $922 profit 🤑 #optiontrading #tradingstrategy". Option Trade JD covered potential trade during 9 Aug Traders Talk Entry 9 Aug Exit 26 Aug Profit $922 | watch till end to see the trade we did 😉 | Option Trades Adjustments - Based on Price Actions | .... YOU'RE MY SUNSHINE.

Hawkish remarks by J Powell crushed the market - pullback expected until Next FOMC in Sept 21. Watch for key points raised #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Hawkish remarks by J Powell crushed the market - pullback expected until Next FOMC in Sept 21. Watch for key points raised #optionstrading #optionsstrategies". Key Points For Traders | Here's what JP said.. | > rates will go up until inflation is down to 2% | .... Flip through.

FACEBOOK

Visit and follow us at our Facebook Page for more contents!

Access here >>Facebook Page<<

DISCLOSURES

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options: https://www.theocc.com/components/docs/riskstoc.pdf

MYstyework is an Online Financial Literacy Educator and materials provided is solely by MYstylework and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Trading securities can involve high risk and the loss of any funds invested. MYstylework, through its contents, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. MYstylework is not in the business of transacting securities trades or an investment adviser.