Options Trading Newsletter - Issue #161 - CONFLICT... [Options Today - SYNTHETIC LONG ON BIDU ]

Conflict...

Conflict…

Conflict is an inherent part of human interaction that many seek to avoid, yet it manifests across various spectrums of society—from global political arenas to personal relationships. Recent years have witnessed significant conflicts, such as the trade tensions between the US and China, military engagements between Russia and Ukraine, and even corporate disputes like those between UAW Union and automotive companies.

On a global scale, conflicts can emerge from geopolitical tensions, economic sanctions, or territorial disputes. These often result in prolonged hardships for nations and their citizens, impacting global markets and international relations. For example, the ongoing conflicts between Israel and Iran not only strain diplomatic relations but also heighten security concerns across the region.

Domestically, conflicts can be equally complex and damaging. Disputes within families or among workers and unions may not capture international headlines, but they significantly affect the individuals involved. These conflicts typically arise when parties are unable to reconcile differing expectations or interests, leading to a breakdown in communication and, often, a legal standoff.

I am somewhat used to corporate conflicts with employees that often escalated to a protracted legal battle. Sometimes certain employees just like to assert their dominance and initiates legal actions against the employer. The last ordeal was in our favor but substantial legal fees effectively consumed any financial savings from the dispute, so technically both sides lost and the lawyers representing the parties won. The real cost, however, was more than monetary; it was emotional and psychological. Some days ago, we heard that the staff had passed away, letting me ponder what good had it been going through such conflict and ordeal for 3 years and end up in tragic. It could have been easily averted if people are less vindictive and have a “must win” mentality.

This experience served as a stark reminder of the destructive potential of unresolved conflicts. It highlighted the need for reconciliation and the value of pursuing mutual understanding and compromise. Conflicts, whether personal or global, often result in no true winners; the aftermath usually leaves all parties worse off, burdened by financial, emotional, or even health-related costs.

In light of these reflections, it becomes evident that harboring vindictive feelings or pursuing aggressive confrontations is seldom worthwhile. Instead, embracing forgiveness and understanding can lead not only to more satisfactory resolutions but also to a more fulfilling life. As we navigate through conflicts, big and small, we must strive to remain true to ourselves, fostering attitudes that promote reconciliation over division. Ultimately, this approach may not only bring peace but could also enhance our well-being and longevity.

"An eye for an eye only ends up making the whole world blind." - Mahatma Gandhi

SPX (5123)

It’s the second week of retracement for SPX. This week it lost 1.5%, 81 points down. CPI was up 3.5% versus forecast of 3.4%. The core PPI of 0.2% as per forecast did not help much on supporting the market as last week the risk was still towards the middle east conflict of Israel/Iran which lead the rally of Gold to all time high and also strengthening of the USD currency. Oil also rallied higher before it sold off later part of the day.

On the daily chart, SPX has closed below the 21 moving average, an indication of short term bearish momentum. With the earnings outlook from banks not very positive, we could probably expect the upward rally to be stalled for a while. In our issue #158 (25 March), we pointed out that the upward momentum has weakened and since, the weekly candles has been red. Overall, the long term bull market is still intact, but short term it is bound for a long awaited retracement, possibly to the 4800 to 4900 levels, depending on how earnings season performs.

On the commodities side, interesting enough, we saw the price action of GLD being sold off after it surged more than $5 hitting all time high before it closed down $2.91 an intraday range of $8.20, not normal for GLD to behave like this. The weekly candle has an extremely long wick perhaps it’s time to ease down on GLD rally considering since February it has gone up by more than 20%. With rates possibly at its high and USD also at its high, it may be increasingly costly to move into such safe heaven asset after all and cashing in on last Friday’s flush up ain’t that bad of an idea short term.

This week may yet prove to be a volatile trading week as over the weekend, Iran sent hundreds of drones and missiles into Israel and that could spark off higher tensions in the middle east conflict. VIX has spiked over to 19 last week and now trading at 17s level. Stay cautious and trade lightly.

Trading range for the week is 5050 to 5200.

NDX (18003)

NDX had a volatile week and continued to trade sideways, failing to breach its previous high. The past 2 weeks trend is rather similar to SPX which is in the red. AAPL which surged over 4% for the past week probably saved the day from NDX performing even worse.

Price action wise, we could still see some volatility towards the downside possibly hitting support at 17500 level. Resistance is still the previous high of around 18500 levels.

The AI related stocks have been less bullish and now and without big names holding up valuations, NDX bullish momentum may likely be in for a change soon.

Trading range for the week is between 17700 to 18200.

HANG SENG INDEX (16721)

HSI closed relatively unchanged for the week after it lost its gains on Wednesday of over 300 points. The trade conflicts between China and US now on the use of US made chips is probably weighing on for profit takings on rallies. But overall, we are still bullish on HSI longer term path and taking opportunities to add position on dips.

After the retracement, mid week on, we see HSI to hold support lower at 16400 also around the 50 MA daily level. HSI has traded below the channel trendline for some weeks now and we are looking for it to form a lower new trendline. Short term daily 21 MA is still sloping up which is good for short term longs.

OPTIONS TODAY - SYNTHETIC LONG ON BIDU

BIDU has been trading within a range of 96-110 since January 2024. It has hit support at 96/97 two times and now coming to a 3rd time as it is trading on Friday at $97.54 after a huge drop of $4.78 last Friday. It’s earnings is coming on 16 May.

Price Thesis

We are looking into possibility of a price support at $96 and looking for a long trade if BIDU finds support here. Nevertheless, the long term price trend for BIDU is still on a downtrend as daily 200 MA is still sloping down. Our long play is short term looking for a quick bounce on oversold position and run-up into earnings. The risk as with all China stocks is the US/China trade tensions.

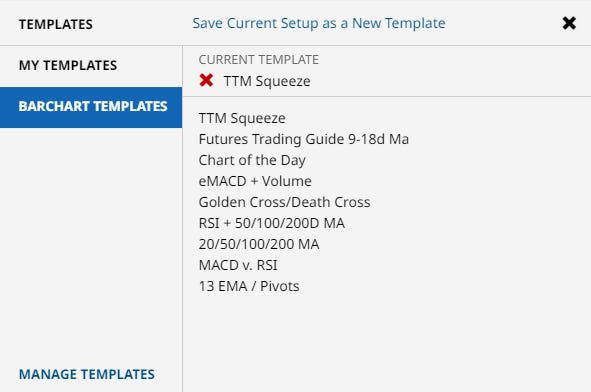

Target Entry, after BIDU drops below and closes back above $96 with a bullish pinbar. Watch the momentum indicator on Barchart to turn colour, indicating a reversal in price trend. (you can apply Barchart.com TTM Squeeze template to get this chart).

Target stop loss, 1.5 Average True Range (ATR) (1.5 x $2.87). Profit Target $104.60.

Assuming an entry price when say BIDU is $96, Stop Loss will be $96 - $4.30 = $91.70.

Trade Entry (DTE 10 May)

We are taking the trade using a Synthetic Stock structure which is by Buying an ATM Call and Selling an ATM Put. A true synthetic option structure will mirror stock holding of 100 shares which means the trade will have a Delta of 100.

We choose DTE 10 May because it has $1 price intervals for the strikes so we can get close to the stock price on entry.

As we want to give ourselves a slight buffer that price may take a bit of time to increase and also possibility it might not even increase according to our thesis, we will move the strikes of the short put lower than ATM to achieve an overall Delta of around 70 for the trade. Basically it means ATM Call at Delta 70 and OTM Short Put at Delta 30. Together 50+30 = 80 Delta. The effects of holding a 80 Detla synthetic option is as good as holding 80 BIDU shares, a $1 move in BIDU will have $0.80 effects on the option price.

Example, Assuming current price of $97.54, an ATM Call will be at strike $98 (Delta 50) and a Delta 30 Short put will be at strike $93. Total cost of trade is $2.60 debit. If BIDU price drops to the stop loss level of $91.70, the losses could go up to around $500 depending on when in time this happens.

Trade Management

Exit trade based on the TP/SL levels.

OPTIONS TODAY - UPDATE ON LONG JAPANESE YEN FUTURES

USD has continued to strengthen against major currencies as CPI data and the middle east conflict has continued to strengthen the USD. The position has now gone ITM and we have started to add in some short call spreads to balance up the positions while waiting for some recovery.

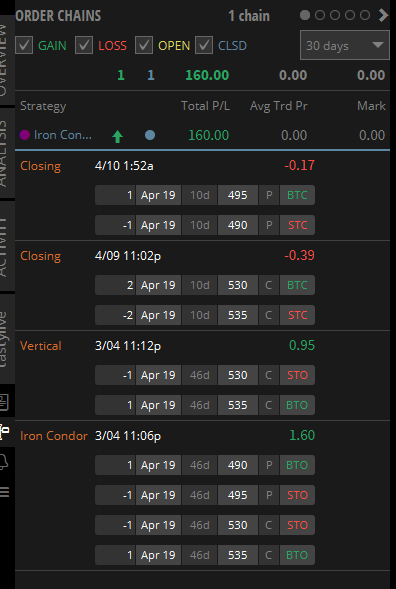

OPTIONS TODAY - TRADE UPDATE IRON CONDOR ON MICRO CRUDE OIL FUTURES - JUNE24

June Crude futures has started to trade sideways after reaching highs of around 87. The middle east escalation could probably leave crude prices escalated and our trade risk is more on the upside. As long as the trade continue to stay below 92 and above 77, we are only waiting for time to pass for the extrinsic value to decay.

OPTIONS TODAY - WINNER - BEAR CALL SPREAD ON SPY

We took the trade off last week before CPI print. The trade made around 60% premium. After our close, SPY continue to drop. We went in at $0.95 and exited at $0.39. Total position, including our Bull Put Spread is profit of $160.

OPTIONS TODAY - TRADE STATUS ON BA RATIO SPREAD

BA did not fair well as more bad news depressed the price. Another whistle blower came in to condemn the company’s issues on its plane development and shoving of safety issues into the rug.

BA came from a year high of $267 to now a year low of $169. As expiry is coming in end of this week, it may be unlikely that it will come back to $180. We have added a short call at $180 just to collect some premium as there is no additional buying power for the short call. With the short call, the trade will now have upside risk as opposed to no upside risk when it was initiated. Anyway, we have a buffer of up to $183.5 before the trade turns to a loss if it goes up above this price.

This week, we will close the 185 long put at a profit and roll the 180 short put in time for it to recover as a naked put. At the same time, we may also add in 1 or up to 2 OTM short calls to generate some premium to cover for the losses of the short put. No additional buying power required but the risk of the short call is infinite (according to definition. A short put and short call is an undefined risk trade - Strangle Strategy and may require more active management with changes in stock price.

HELP US GROW

If you find our Newsletter insightful and helps you in your trading, please help us by sharing it to your friends. Your help in getting more people engaged will be great inspiration to us to continue sharing our thoughts on the market and options trading. There are hundred of readers getting insights weekly, if each of you add one subscriber for us one week, we will explode in time and can do much more for the readers when we achieve a larger audience. Thank you in advance for letting the word out!

TRADERS TALK

Review some of our most interesting trade shows in past Traders Talk. The training topics touched are useful insights and relevant if you want to understand the depth of options trading and strategies.

View Past Traders Talk here.

TIKTOK VIDEOS

If you like our videos, please give us a ❤️ or drop a comment on it!

Believe. It only takes 1 minute to change your life. #believe #motivation #inspiration #life #success

Understand this and you will gain a fulfilling life...😌 #motivation #success #inspiration #lifegoals

Earnings play on HOOD

Life is a play. Your are your own director, screemwriter & actor in life's play. #motivation #success

We can no longer live the way our parents did, the world have changed. Don't conpromise your family and our future generations... evolve with the times..understand it and we will prosper.

We start a market education series to help aspiring traders understand how to become successful in trading.

Market Psychology…

What drives the market? Understand this to be a better trader 😉 #stockmarket #trading #bullrun

Struggles… Pain is inevitable, suffering is Optional.

So make each drop of your sweat worth it throughout your struggles in life... 😉

#struggles #motivation #inspirationalquotes

Happy New Year and May 2024 open new doors for you…

Merry Christmas & Happy New Year… May 2024 be blessed with new beginnings and continued success for all…

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

AI Validation on Options Strategy - GLD ETF using Strangle. We used ChatGPT Code Interpreter to backtest the strategy and WIN probabilities. #AI #optionstrading #chatgpt #codeinterpreter

Options Today - Bullish Trade on Apple. Increase Probability of Profits from below 40% to more than 80%. Trade as explained in our Options Trading Newsletter No.124. 31 July 23

Options Today - Trade on GLD As described in our Options Trading Newsletter Issue No.123, Jade Lizard on GLD. Entry 26.7.23. [This video is AI from my personal voice] 🤭 #optionsstrategy

Understanding IV - Part 1 - Understanding IV relation to options premium and how to read different measurement of IVs.

Understanding IV- Part 2 - How to use IV to trade GLD ETF.

DELTA is one of the most important Options Greek. Understand what it represents and how to use it to improve tour trading and how it is used for hedging and also capital and return management.

Iron Condor Trade on XOP. Get FREE petrol trading options. FREE Options Trading Newsletter https://mystylework.substack.com.

How to use Advanced Options Strategies to hedge your long term stock investment for free. Learn Options Trading for Free

Trading Options Using Jade Lizzard strategy. Get free petrol subsidies trading XOM 😏 #optionstrading #investing101 #stockmarket #xom

Banks don't want you to know this secret. Revealed in one of our earlier Traders Talk in June 2021. #banksecrets #investing101 🌈✨🏝️

Generate Property like cash flows from the stock market with only one fifth the capital. #Hello2023 #propertyinvesting #rentalincome #investing #stockmarket

Investing 101. It is difficult to catch the bottom and catch the best prices but we can tranch in our buy points so we can get the best overall long term returns without missing the boat. #hello2023 #investing #apple

Trade Digest on XBI - Trading Range using Iron Condor options strategy live from Traders Talk 27 Dec 22. #optionstrading #tastyworks

Long Trade on JD. Trade setup from Traders Talk 6 Dec 22 #optionstrading #tastyworks — www.tiktok.com TikTok video from Mystylework (@mystylework.trade): "Long Trade on JD. Trade setup from Traders Talk 6 Dec 22 #optionstrading #tastyworks". JD Long Trade | 6 Dec 22 Traders Talk | Like & Share ♥️. Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Trade Digest On XLE using Iron Condor #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Trade Digest On XLE using Iron Condor #optionstrading #optionsstrategies". Iron Condor on XLE | Trading in Range Use A Neutral strategy | Iron Condor | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

5 ways to reduce cost of calls. The ultimate traders' guide. #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "5 ways to reduce cost of calls. The ultimate traders' guide. #optionstrading #optionsstrategies". 5 Ways To Reduce Cost Of Calls | options trading | traders | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Trading options with 68.2% probability using Expected Move 😎 #optionstrading #trading101 — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Trading options with 68.2% probability using Expected Move 😎 #optionstrading #trading101". Expected Move | How to trade options | trading options | .... Corporate Uplifting Inspirational Motivational Pop Rock Piano Violins Theme Song.

mystylework.trade (@mystylework.trade) on TikTok — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade). Butterfly Trade | How to setup low cost high returns options trade | Learn to trade options | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Winning Options Strategies everyday. Creating high probability low risk trades 😎 #optionstrading #optionsstrategies #elonmusk @tastytrade — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Winning Options Strategies everyday. Creating high probability low risk trades 😎 #optionstrading #optionsstrategies #elonmusk @tastytrade". Elon Musk | Stock trading | Another WIN 😎 | .... Sunrise.

Twitter shareholder's meeting for takeover by Elon Musk 13 Sep 22, 10am. Lets trade... #optionstrading #optionsstrategies @tastytrade — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Twitter shareholder's meeting for takeover by Elon Musk 13 Sep 22, 10am. Lets trade... #optionstrading #optionsstrategies @tastytrade". select Nov 18 expiry | Sell ATM call strike 43 | recheck ATM price on open on Monday | .... TikTok's song-like tropical house(974524).

J.Powell's Message yesterday in 1 minute... @tastytrade #optionstrading #optionstrading #stockmarket — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "J.Powell's Message yesterday in 1 minute... @tastytrade #optionstrading #optionstrading #stockmarket". Fed Message??? 🏦 | Responsibility For Price Stability.... | Inflation Target | .... Suns.

What to expect for this week's market.. #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "What to expect for this week's market.. #optionstrading #optionsstrategies". SPX down 141 points (3.37%) last Friday after J.Powell speech | Monday another 27 points drop | but we see some slight support at 4000 level above daily 50 MA | .... Change My Mind.

Option Trade on JD - watchlist at last Traders Talk on 9 Aug. Closed today $922 profit 🤑 #optiontrading #tradingstrategy — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Option Trade on JD - watchlist at last Traders Talk on 9 Aug. Closed today $922 profit 🤑 #optiontrading #tradingstrategy". Option Trade JD covered potential trade during 9 Aug Traders Talk Entry 9 Aug Exit 26 Aug Profit $922 | watch till end to see the trade we did 😉 | Option Trades Adjustments - Based on Price Actions | .... YOU'RE MY SUNSHINE.

Hawkish remarks by J Powell crushed the market - pullback expected until Next FOMC in Sept 21. Watch for key points raised #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Hawkish remarks by J Powell crushed the market - pullback expected until Next FOMC in Sept 21. Watch for key points raised #optionstrading #optionsstrategies". Key Points For Traders | Here's what JP said.. | > rates will go up until inflation is down to 2% | .... Flip through.

FACEBOOK

Visit and follow us at our Facebook Page for more contents!

Access here >>Facebook Page<<

DISCLOSURES

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options: https://www.theocc.com/components/docs/riskstoc.pdf

MYstyework is an Online Financial Literacy Educator and materials provided is solely by MYstylework and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Trading securities can involve high risk and the loss of any funds invested. MYstylework, through its contents, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. MYstylework is not in the business of transacting securities trades or an investment adviser.