Ageing Vessels… [Options Today-Strangle on GLD 9% Return/month]

Every year, our age ticks upward, an unyielding march of time. As we grow older, the window of opportunity to enjoy our years in good health narrows. Despite the advancements in medical science, we have yet to unlock the secret to immortality. Although, who knows? Perhaps in the not-too-distant future, we might be able to transfer our consciousness into machines and achieve a kind of eternal life.

However, until that day comes, our bodies remain our only vessels. Yet, it's all too common for us to neglect our health until our bodies send out distress signals. If you've been fortunate enough not to reach that point, I urge you to reconsider your priorities. It's never too late to adopt a healthier lifestyle: from eating nutritiously, engaging in regular physical activity, ensuring adequate sleep, practicing mindfulness through meditation, and more. These habits can enhance your well-being and potentially extend your life's "expiry date."

A common refrain I hear is, "I just don't have the time." But let's be honest: we all have the same 24 hours in a day. How we choose to spend those hours is a reflection of our priorities. If we're consistently choosing work or leisure over our health, it's less about time and more about discipline and determination. I confess I've been guilty of this too.

So, let's make a pact. What's the point of amassing wealth if we're not healthy enough to enjoy it? For the love of life and the desire to experience it fully for as long as possible, let's return to the basics. Begin by scheduling regular exercise sessions - it's often the most challenging habit to establish. Once that's in place, other habits like better eating and adequate rest become easier to manage.

Hold yourself accountable. If you miss a workout, impose a penalty on yourself, like skipping an episode of your favorite Netflix show or taking a break from social media. After a month of this regimen, reflect on your progress and adjust as needed.

Remember, every step you take towards a healthier life now might reward you with more cherished moments in the future. Share this message with someone you care about, and together, let's strive for better, longer lives.

"Time is finite, but health amplifies its value."

SPX (4450)

SPX had quite a bad red day on Friday shedding 55 points (1.2%) closing at 4450, just sitting on the 21 daily EMA.

During mid week, CPI was released and it clocked 3.7% against 3.6%. Eventhough core PPI was 0.3% slightly higher than the 0.2% forecast, market did not take it that bad, probably it had already factored that the inflation would not be any lower than expected due to one of the key CPI component, energy prices which remained high since several months now.

The selloff only took in end of the week as that is also the September monthly expiry and triple witching day (stock options, index futures and index options all expires on same day). Typically triple witching days are volatile and ends in the red due to rollover of contracts. We had some puts on the day before but sold it off too early during the day as we saw some sideway movements after the first drop.

What to expect in the next week? It’s nobody’s guess but we just need to monitor the price actions, short term if the 21 daily EMA holds and if not, the next level of support will be at 4430 and then 4415. On the upper side, resistance at last high of 4512. But we see that 4450 is the volume point of control as prices have been staying at this level for the past 2 weeks. If it gets support here, we are likely to get back up and if it breaks down, we could see the lower support being tested.

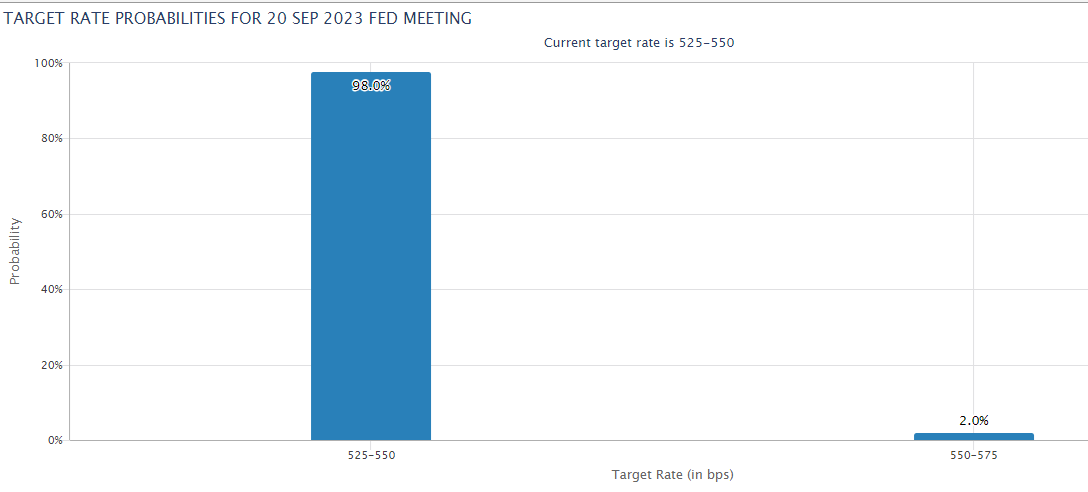

We could come into a volatile week as the Fed Fund Rate ix expected on Wednesday trading day 20 September. Market expectation is for the rate to stay put at the next meeting. Market has placed a 98% probability of rate staying at where it is now.

The trading range for the week is between 4400 and 4500.

NDX (15202)

NDX ended up lower for the week by 78 points (0.5%). On Friday it went down 271 points (1.75%) closing at 15202, holding at 21 EMA as support.

With most tech stocks giving back the winning of the week on Friday’s down move, we could expect that any small good news in the market to pull back these stocks up. We are watching Netflix closely as it had quite a nasty fall for the week, 10% down 46 points shed due to the negativity on statements made by the CFO on margins and subscriber growth.

The significant oversold position could be a bullish trade opportunity. If we could see NDLX closing above 398 level, we could see that it recovers some of the 10% loss in the next weeks. Although premature, we placed a defined risk debit call spread to see a possibility of a quick bounce this week. However if it fails, we could see the downside going back to 360 levels.

The trading range for the week is between 15000 and 15400.

HANG SENG INDEX (18182)

It is a choppy week for HSI as there are many resistance above. We went long on our position on Monday and exited on Friday morning opening taking in close to 300 points in profits. The Industrial Production and Retail Sales data released on Friday morning gave HSI a small boost up to 18372 but it failed to maintain this level and went down below 18200 level. We actually took a short position on MHI at 18350 level with a tight stop at 18406 and were taken out by a couple of points as high for day was 18418 before it went all way back down.

As 18200 was resistance earlier, we could see this as the support level next. We still keep a lookout for potential long positions if it retraces below again.

As HSI is building a base between 18000 and 18200, we are watching for another attempt to breakout above 18200 level. The main catalyst would be more positive newsflows on governmental support on the ailing economy. As we move into the Golden Week holidays early October, potentially a pre-holiday rally could be expected.

OPTIONS TODAY [Strangle on GLD 9% Return/month]

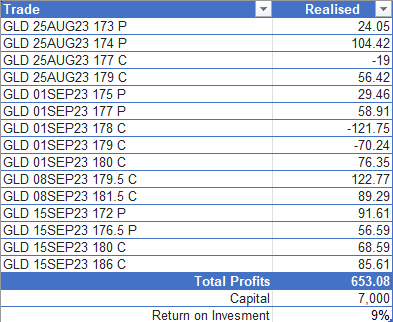

We revisit our results on the GLD Strangle Strategy we had validated by ChatGPT done earlier on our 14 August Options Trading Newsletter Issue #126.

Short recap, we used chat GPT to analyse the weekly 1 standard deviation move of GLD and checked the past 1 year data to determine if GLD has moved beyond 1 SD and the results was, GLD has not moved out of 1 SD most of the time. So with this we structured a weekly GLD Strangle trade selling the weekly expected move up/down calls and put.

We did 2 contracts per week, with buying power of around $7000. The results was as below. One week, the call went ITM and we rolled it for the following week and expired back OTM. One put was assigned as we forgot to roll it on expiry, but we closed the stock position the following week at breakeven.

As you can see the results was not too bad for a 9% return per month. Price action wise we can see that GLD has been moving sideways, perfect for a strangle strategy as prices tend to come back to the mean after 1 month.

Still no strategy is fool proof and if GLD price action was one strong on a single direction, we have to implement our stop loss strategy at 2x the premium received. Also, do not over rely on a single strategy and we need also to diversify our portfolio/strategies.

We will continue to implement this strategy and share the results at next issues. At the same time, we continue to look for low volatility ETF/Stocks to implement similar strategies. If you come across any ETF/Stocks, please share with us so we can look into the analysis and ask ChatGPT to analyse it for us.

OPTIONS TODAY [Update on APPL Earnings Trade]

AAPL short put of 180 went ITM, we rolled the short put for a week to 22 Sept for 28 cents credit.

TRADERS TALK

Review our past traders talk. View Past Traders Talk here.

Follow-us so you will be notified when we go live! Follow and click on the notification button, so you will never miss a show.

TIKTOK VIDEOS

AI Validation on Options Strategy - GLD ETF using Strangle. We used ChatGPT Code Interpreter to backtest the strategy and WIN probabilities. #AI #optionstrading #chatgpt #codeinterpreter

Options Today - Bullish Trade on Apple. Increase Probability of Profits from below 40% to more than 80%. Trade as explained in our Options Trading Newsletter No.124. 31 July 23

Options Today - Trade on GLD As described in our Options Trading Newsletter Issue No.123, Jade Lizard on GLD. Entry 26.7.23. [This video is AI from my personal voice] 🤭 #optionsstrategy

Understanding IV - Part 1 - Understanding IV relation to options premium and how to read different measurement of IVs.

Understanding IV- Part 2 - How to use IV to trade GLD ETF.

DELTA is one of the most important Options Greek. Understand what it represents and how to use it to improve tour trading and how it is used for hedging and also capital and return management.

Iron Condor Trade on XOP. Get FREE petrol trading options. FREE Options Trading Newsletter https://mystylework.substack.com.

How to use Advanced Options Strategies to hedge your long term stock investment for free. Learn Options Trading for Free

Trading Options Using Jade Lizzard strategy. Get free petrol subsidies trading XOM 😏 #optionstrading #investing101 #stockmarket #xom

Banks don't want you to know this secret. Revealed in one of our earlier Traders Talk in June 2021. #banksecrets #investing101 🌈✨🏝️

Generate Property like cash flows from the stock market with only one fifth the capital. #Hello2023 #propertyinvesting #rentalincome #investing #stockmarket

Investing 101. It is difficult to catch the bottom and catch the best prices but we can tranch in our buy points so we can get the best overall long term returns without missing the boat. #hello2023 #investing #apple

Trade Digest on XBI - Trading Range using Iron Condor options strategy live from Traders Talk 27 Dec 22. #optionstrading #tastyworks

Long Trade on JD. Trade setup from Traders Talk 6 Dec 22 #optionstrading #tastyworks — www.tiktok.com TikTok video from Mystylework (@mystylework.trade): "Long Trade on JD. Trade setup from Traders Talk 6 Dec 22 #optionstrading #tastyworks". JD Long Trade | 6 Dec 22 Traders Talk | Like & Share ♥️. Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Trade Digest On XLE using Iron Condor #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Trade Digest On XLE using Iron Condor #optionstrading #optionsstrategies". Iron Condor on XLE | Trading in Range Use A Neutral strategy | Iron Condor | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

5 ways to reduce cost of calls. The ultimate traders' guide. #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "5 ways to reduce cost of calls. The ultimate traders' guide. #optionstrading #optionsstrategies". 5 Ways To Reduce Cost Of Calls | options trading | traders | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Trading options with 68.2% probability using Expected Move 😎 #optionstrading #trading101 — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Trading options with 68.2% probability using Expected Move 😎 #optionstrading #trading101". Expected Move | How to trade options | trading options | .... Corporate Uplifting Inspirational Motivational Pop Rock Piano Violins Theme Song.

mystylework.trade (@mystylework.trade) on TikTok — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade). Butterfly Trade | How to setup low cost high returns options trade | Learn to trade options | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Winning Options Strategies everyday. Creating high probability low risk trades 😎 #optionstrading #optionsstrategies #elonmusk @tastytrade — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Winning Options Strategies everyday. Creating high probability low risk trades 😎 #optionstrading #optionsstrategies #elonmusk @tastytrade". Elon Musk | Stock trading | Another WIN 😎 | .... Sunrise.

Twitter shareholder's meeting for takeover by Elon Musk 13 Sep 22, 10am. Lets trade... #optionstrading #optionsstrategies @tastytrade — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Twitter shareholder's meeting for takeover by Elon Musk 13 Sep 22, 10am. Lets trade... #optionstrading #optionsstrategies @tastytrade". select Nov 18 expiry | Sell ATM call strike 43 | recheck ATM price on open on Monday | .... TikTok's song-like tropical house(974524).

J.Powell's Message yesterday in 1 minute... @tastytrade #optionstrading #optionstrading #stockmarket — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "J.Powell's Message yesterday in 1 minute... @tastytrade #optionstrading #optionstrading #stockmarket". Fed Message??? 🏦 | Responsibility For Price Stability.... | Inflation Target | .... Suns.

What to expect for this week's market.. #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "What to expect for this week's market.. #optionstrading #optionsstrategies". SPX down 141 points (3.37%) last Friday after J.Powell speech | Monday another 27 points drop | but we see some slight support at 4000 level above daily 50 MA | .... Change My Mind.

Option Trade on JD - watchlist at last Traders Talk on 9 Aug. Closed today $922 profit 🤑 #optiontrading #tradingstrategy — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Option Trade on JD - watchlist at last Traders Talk on 9 Aug. Closed today $922 profit 🤑 #optiontrading #tradingstrategy". Option Trade JD covered potential trade during 9 Aug Traders Talk Entry 9 Aug Exit 26 Aug Profit $922 | watch till end to see the trade we did 😉 | Option Trades Adjustments - Based on Price Actions | .... YOU'RE MY SUNSHINE.

Hawkish remarks by J Powell crushed the market - pullback expected until Next FOMC in Sept 21. Watch for key points raised #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Hawkish remarks by J Powell crushed the market - pullback expected until Next FOMC in Sept 21. Watch for key points raised #optionstrading #optionsstrategies". Key Points For Traders | Here's what JP said.. | > rates will go up until inflation is down to 2% | .... Flip through.

Visit and follow us at our Facebook Page for more contents!

Access here >>Facebook Page<<

DISCLOSURES

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options: https://www.theocc.com/components/docs/riskstoc.pdf

MYstyework is an Online Financial Literacy Educator and materials provided is solely by MYstylework and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Trading securities can involve high risk and the loss of any funds invested. MYstylework, through its contents, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. MYstylework is not in the business of transacting securities trades or an investment adviser.