Options Trading Newsletter - Issue #134

What's Your Limit?... [Option Today - Long Trade on XOP]

What’s Your Limit?… [Options Today - Long Trade on XOP]

Saturday mornings often unfold leisurely, providing a much-needed respite after the hectic pace of the workweek and the buzz of Friday night markets. This particular Saturday was no different, with the lure of Netflix pulling me into a relaxed binge-watching session, my eyes fixed on a German movie titled "Race to Summit" – a captivating tale centered on alpinism.

"Race to Summit" immerses viewers in the compelling world of mountain climbing, a realm where individuals constantly push the boundaries of physical and mental endurance to navigate treacherous terrains and attain soaring altitudes. The film's protagonist, Swiss alpinist Ueli Steck, particularly caught my attention.

Ueli Steck catapulted to fame through his extraordinary feat of scaling Mount Eiger, a daunting peak rising to 3,967 meters, in an astonishing record time of 2 hours and 47 minutes. What's even more remarkable is that Steck accomplished this without relying on ropes, moving with a speed and agility that seemed almost akin to running.

However, records in the alpinist community are fleeting, with Steck’s initial triumph eventually overshadowed by another climber, Dani Arnold. Undeterred, Steck revisited Mount Eiger, ascending its heights once again to reclaim his record with a new, faster time of 2 hours and 22 minutes.

Beyond the thrill of holding records, these accolades carry significant financial implications for alpinists. Record-holders often enjoy lucrative endorsement deals, sponsorships, public appearance fees, and book royalties. In this competitive field, only the best can hope to garner such rewards and recognition.

Yet, every pursuit has its limits, defined by age, physical capabilities, and other inherent constraints. Ueli Steck’s journey, while filled with moments of glory, met a tragic end during a training session on Mount Everest. It prompts reflection on the true worth of pushing oneself to the extreme. While some might view Steck's daring endeavors as worthwhile, I regard the relentless pursuit of extremes as a perilous venture laden with inevitable risks and potential losses.

This perspective isn't limited to mountain climbing; it applies to various aspects of life, including trading. No matter how confident and skilled a trader you might be, staking all on a single trade with blind conviction can lead to disastrous consequences.

Life, in its essence, is not a sprint but a marathon. Success isn't merely about reaching specific milestones; it's also about sustainability and longevity in one’s chosen field. The journey doesn’t end upon crossing a finish line; instead, new objectives and goals continuously emerge, urging us to press on, to stay engaged, and to remain in the game for the long haul.

“The key to immortality is first living a life worth remembering.” - Bruce Lee

SPX (4308)

SPX closed this week at the upper range its weekly range. The ADP and Non-Farm Payroll cameout this week with mixed numbers. ADP was below forecast whereas Non-Farm was far above forecast.

Whilst the Non-Farm Employment Change of 336k against forecast of 171k, the market rallied after an initial drop on futures post release. So what’s the play here? Have the selldown completed and all news fully priced in?

If we look deeper into shorter timeframe, we would see that the jump last Friday would face resistance already and likely to come down this week. Even if it comes down, we could see that below the current levels holds strong support, first last week support level at 4220. The second is the demand area between 4100 and 4170 could be another support area for SPX.

If SPX goes higher, the next target would probably be the gap fill to 4400 level. These 2 sided price action works well still for neutral strategies. The SPY Iron Condor we entered 2 weeks ago is still at neutral delta (-2).

Expect some volatility this week due to the geo-political tensions due to the attack on Israel. Trading range for the week is 4150 and 4350.

DXY has been moving nicely above the daily 21 EMA for past several months. Unless it breaks below this daily 21 EMA trendline, we would still see a choppy scenario on SPX and not confirming a reversal of the downtrend.

GLD seem to have found support for now at 168. We have stopped the 1 SD strangle as the past 2 weeks, the short puts got tested more than 1 SD but level but last week was much less due to the price rebounce. The short puts at 177 two weeks ago was assigned and we are selling calls for time being while we rolled the short puts of 171 for the trades last week. With a rebounce in gold, we should be out of these positions in due time. We would probably look to reenter these the strangle trades if GLD reaches 175 level.

NDX (14973)

NDX had moved up 1.75% (258 points) for the week after finding support at 14600 level for the past 2 weeks. The move last week had filled the price gap of 21 September and we should see some retracement from the huge move last Friday on opening this week.

Last Thursday we went in a quick long play using Bull Call Spread on QQQ and exited on Friday for some quick profits.

CPI announcement is expected on Thursday and market volatility would set to increase heading towards that. Until then, we would stay out of the market for any new trades apart from existing running trades or day trading positions.

Trading range for the week is between 14600 to 15350.

As expected, the bargain hunters came in last week on some of the NDX Magnificent 7 as they found some relief bouncing up together with the broader market. This should work well into the October option expiries for our short put position on MSFT.

Last week was mostly green days for AAPL moving up $6.28 (3.67%) for the week closing at 177.49. Our AAPL position was assigned at 180 and we continued to sell calls since assignment. For now, we should be fine if AAPL stays put at this level for the week and allow us to sell another short call at 180 and above next week for more premiums.

HANG SENG INDEX (17485)

HSI has been on a downtrend after the last rally in September failed to break above 18900. It could likely retest 17000 level soon.

On a shorter timeframe, we could see clearly the lower low lower high patterns which works well for our day trade positions. The resistance level alongside the daily 100 MA is a good level to monitor the price action. Each big swing move down is recovered at least by 50-60% before moving down lower. We try to catch these big swings in our daytrades.

OPTIONS TODAY [LONG TRADE ON XOP]

Crude oil had decline over the past 2 weeks and bounced off its low of 81.50 last week. The geo-political tensions on strike on Israel by HAMAS should give some further price pressure up on oil for the next few days.

Alongside the prices of oil, we see that XOP has also traded lower after it hit resistance on the support turned resistance long term trendline since 2021.

For now, it is acceptable to go long again on XOP on a more aggressive naked put play by selling a 25 Delta short put at strike 130. XOP is currently trading at 139.45 and we expect it to go up further on opening today. So you may need to watch your entry level again after opening today.

In addition to the naked put, we would also want to buy in some insurance on the downside because of the resistance line at 153 level. For this we can enter into a Bear Call Spread selling a short call at 153 and buying a long call at 158.

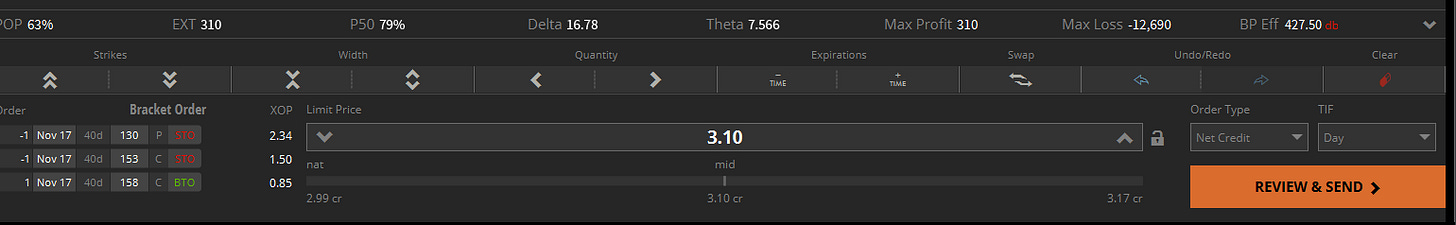

Trade Entry (Nov 17 Expiry)

Naked Put (Delta 25) Sell short put at 130 for $2.39

Bear Call Spread (Delta 20) Sell Short Call 153 & Buy Long Call 158 for $0.71 premium. Max Loss is $4.29 for the Bear Call Spread.

Total premium collected is $3.10 with buying power of $4.27.

Risk Management

The trade has a risk of $1.90 if XOP goes above 158 on expiry.

The trade has a max loss of $126.90 if XOP goes down to zero, probably unlikely…

So we need only manage the naked put if price drops down below 130 level by rolling for more time and premiums.

What we expect on the price action is that XOP rallies back to to test the 153 level and then hit resistance and bounce back lower. So we could see the trade to go into losses on the Bear Call Spread at the initial stage and as price rally up and then the Bear Call Spread goes back into profits as it nears expiry as price goes or stays below 153 level. The bullish momentum on oil short term should have positive effect on the naked put.

We could exit if the overall trade goes to 50% profit level.

HELP US GROW

Thanks for being a regular reader of our newsletter. We hope you had enjoyed reading as much as we enjoyed delivering it to you over more than 2 years now. If you value what we write, we hope you can help us grow our readership. We have just touched 13 US states and 19 countries. We think we can do better with your help as you would know 1-2 friends in states or countries which we are not there yet. Recommend us to your friends, share what you have learnt from us as they might too benefit from it… Thanks in advance 😉.

TRADERS TALK

Review our past traders talk. View Past Traders Talk here.

Follow-us so you will be notified when we go live! Follow and click on the notification button, so you will never miss a show.

TIKTOK VIDEOS

AI Validation on Options Strategy - GLD ETF using Strangle. We used ChatGPT Code Interpreter to backtest the strategy and WIN probabilities. #AI #optionstrading #chatgpt #codeinterpreter

Options Today - Bullish Trade on Apple. Increase Probability of Profits from below 40% to more than 80%. Trade as explained in our Options Trading Newsletter No.124. 31 July 23

Options Today - Trade on GLD As described in our Options Trading Newsletter Issue No.123, Jade Lizard on GLD. Entry 26.7.23. [This video is AI from my personal voice] 🤭 #optionsstrategy

Understanding IV - Part 1 - Understanding IV relation to options premium and how to read different measurement of IVs.

Understanding IV- Part 2 - How to use IV to trade GLD ETF.

DELTA is one of the most important Options Greek. Understand what it represents and how to use it to improve tour trading and how it is used for hedging and also capital and return management.

Iron Condor Trade on XOP. Get FREE petrol trading options. FREE Options Trading Newsletter https://mystylework.substack.com.

How to use Advanced Options Strategies to hedge your long term stock investment for free. Learn Options Trading for Free

Trading Options Using Jade Lizzard strategy. Get free petrol subsidies trading XOM 😏 #optionstrading #investing101 #stockmarket #xom

Banks don't want you to know this secret. Revealed in one of our earlier Traders Talk in June 2021. #banksecrets #investing101 🌈✨🏝️

Generate Property like cash flows from the stock market with only one fifth the capital. #Hello2023 #propertyinvesting #rentalincome #investing #stockmarket

Investing 101. It is difficult to catch the bottom and catch the best prices but we can tranch in our buy points so we can get the best overall long term returns without missing the boat. #hello2023 #investing #apple

Trade Digest on XBI - Trading Range using Iron Condor options strategy live from Traders Talk 27 Dec 22. #optionstrading #tastyworks

Long Trade on JD. Trade setup from Traders Talk 6 Dec 22 #optionstrading #tastyworks — www.tiktok.com TikTok video from Mystylework (@mystylework.trade): "Long Trade on JD. Trade setup from Traders Talk 6 Dec 22 #optionstrading #tastyworks". JD Long Trade | 6 Dec 22 Traders Talk | Like & Share ♥️. Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Trade Digest On XLE using Iron Condor #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Trade Digest On XLE using Iron Condor #optionstrading #optionsstrategies". Iron Condor on XLE | Trading in Range Use A Neutral strategy | Iron Condor | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

5 ways to reduce cost of calls. The ultimate traders' guide. #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "5 ways to reduce cost of calls. The ultimate traders' guide. #optionstrading #optionsstrategies". 5 Ways To Reduce Cost Of Calls | options trading | traders | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Trading options with 68.2% probability using Expected Move 😎 #optionstrading #trading101 — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Trading options with 68.2% probability using Expected Move 😎 #optionstrading #trading101". Expected Move | How to trade options | trading options | .... Corporate Uplifting Inspirational Motivational Pop Rock Piano Violins Theme Song.

mystylework.trade (@mystylework.trade) on TikTok — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade). Butterfly Trade | How to setup low cost high returns options trade | Learn to trade options | .... Lazy chill out, romance overseas celebrity, 10 minutes(1019319).

Winning Options Strategies everyday. Creating high probability low risk trades 😎 #optionstrading #optionsstrategies #elonmusk @tastytrade — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Winning Options Strategies everyday. Creating high probability low risk trades 😎 #optionstrading #optionsstrategies #elonmusk @tastytrade". Elon Musk | Stock trading | Another WIN 😎 | .... Sunrise.

Twitter shareholder's meeting for takeover by Elon Musk 13 Sep 22, 10am. Lets trade... #optionstrading #optionsstrategies @tastytrade — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Twitter shareholder's meeting for takeover by Elon Musk 13 Sep 22, 10am. Lets trade... #optionstrading #optionsstrategies @tastytrade". select Nov 18 expiry | Sell ATM call strike 43 | recheck ATM price on open on Monday | .... TikTok's song-like tropical house(974524).

J.Powell's Message yesterday in 1 minute... @tastytrade #optionstrading #optionstrading #stockmarket — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "J.Powell's Message yesterday in 1 minute... @tastytrade #optionstrading #optionstrading #stockmarket". Fed Message??? 🏦 | Responsibility For Price Stability.... | Inflation Target | .... Suns.

What to expect for this week's market.. #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "What to expect for this week's market.. #optionstrading #optionsstrategies". SPX down 141 points (3.37%) last Friday after J.Powell speech | Monday another 27 points drop | but we see some slight support at 4000 level above daily 50 MA | .... Change My Mind.

Option Trade on JD - watchlist at last Traders Talk on 9 Aug. Closed today $922 profit 🤑 #optiontrading #tradingstrategy — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Option Trade on JD - watchlist at last Traders Talk on 9 Aug. Closed today $922 profit 🤑 #optiontrading #tradingstrategy". Option Trade JD covered potential trade during 9 Aug Traders Talk Entry 9 Aug Exit 26 Aug Profit $922 | watch till end to see the trade we did 😉 | Option Trades Adjustments - Based on Price Actions | .... YOU'RE MY SUNSHINE.

Hawkish remarks by J Powell crushed the market - pullback expected until Next FOMC in Sept 21. Watch for key points raised #optionstrading #optionsstrategies — www.tiktok.com TikTok video from mystylework.trade (@mystylework.trade): "Hawkish remarks by J Powell crushed the market - pullback expected until Next FOMC in Sept 21. Watch for key points raised #optionstrading #optionsstrategies". Key Points For Traders | Here's what JP said.. | > rates will go up until inflation is down to 2% | .... Flip through.

FACEBOOK

Visit and follow us at our Facebook Page for more contents!

Access here >>Facebook Page<<

DISCLOSURES

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options: https://www.theocc.com/components/docs/riskstoc.pdf

MYstyework is an Online Financial Literacy Educator and materials provided is solely by MYstylework and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Trading securities can involve high risk and the loss of any funds invested. MYstylework, through its contents, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. MYstylework is not in the business of transacting securities trades or an investment adviser.